Frequently Asked Questions

All about the Assumable Mortgage and Assumable.io

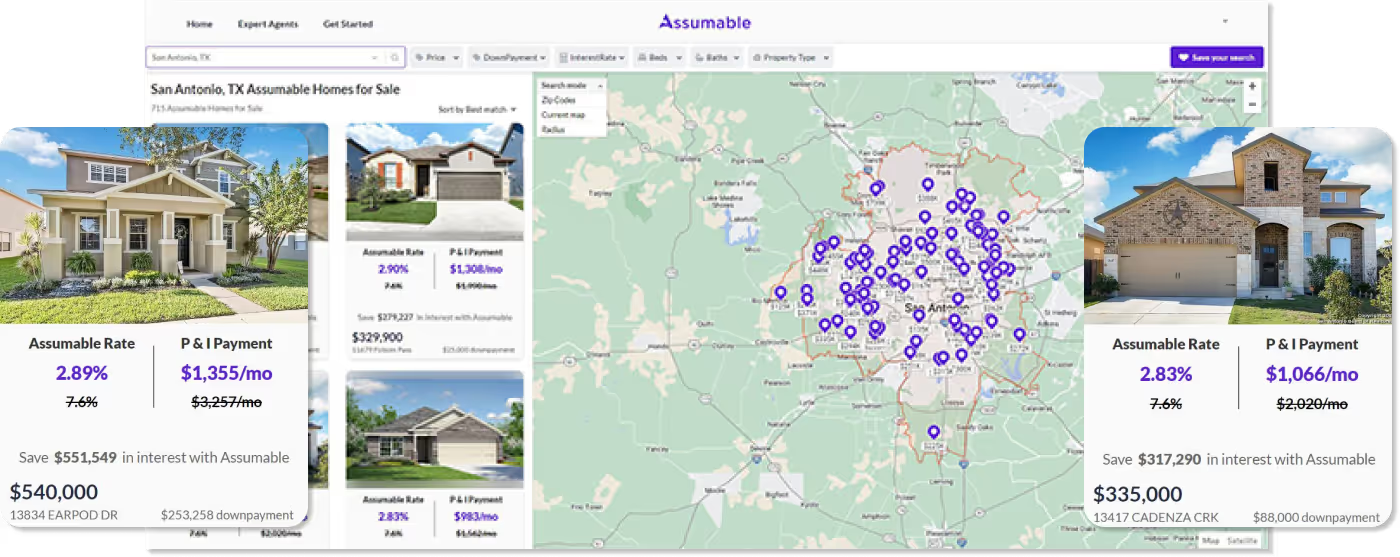

Assumable is a platform that helps you find and buy homes for sale with an assumable mortgage. Assumable uses rich data from leading sources in the United States to verify whether a home has an FHA or VA assumable loan, It's estimated interest rate, and other important details.

Assumable is the leading platform for finding Assumable Mortgages near you. Easily search active assumable mortgage listings and discover the existing interest rate, potential savings, and more.

The assumable mortgage presents the greatest money-saving opportunity most Americans have ever seen. You can save thousands a month and hundreds of thousands in interest over the life of your loan with an assumable mortgage. You should consider an assumable mortgage if you are a savvy buyer who wants to achieve their financial dreams.

Sellers who take advantage of marketing their home with an assumable mortgage can potentially bring more buyers to the table and fetch a higher selling price. Assumable can help you get top dollar for your assumable home.

Assumable loans are government-backed mortgages. Typically FHA, VA, and USDA. Since 1986 all government-backed mortgages are assumable. This means you can assume the existing mortgage on a home and maintain its existing terms and most importantly its existing interest rate.

You must meet the requirements of the lender on the existing mortgage. Typically this includes evaluating your credit score, income, and the typical other factors. Assumable helps you through this process with the servicer to ensure a smooth assumption.

To complete your assumption you must cover the equity in the home you want to buy. Assumable clearly lists this estimated cost on each listing. We are working in earnest with lenders to make assumable mortgages more affordable - stay tuned for more details.

Generally if you have an FHA, VA, or USDA loan, your home is assumable. If you are unsure please contact us and we can help you.

.svg)