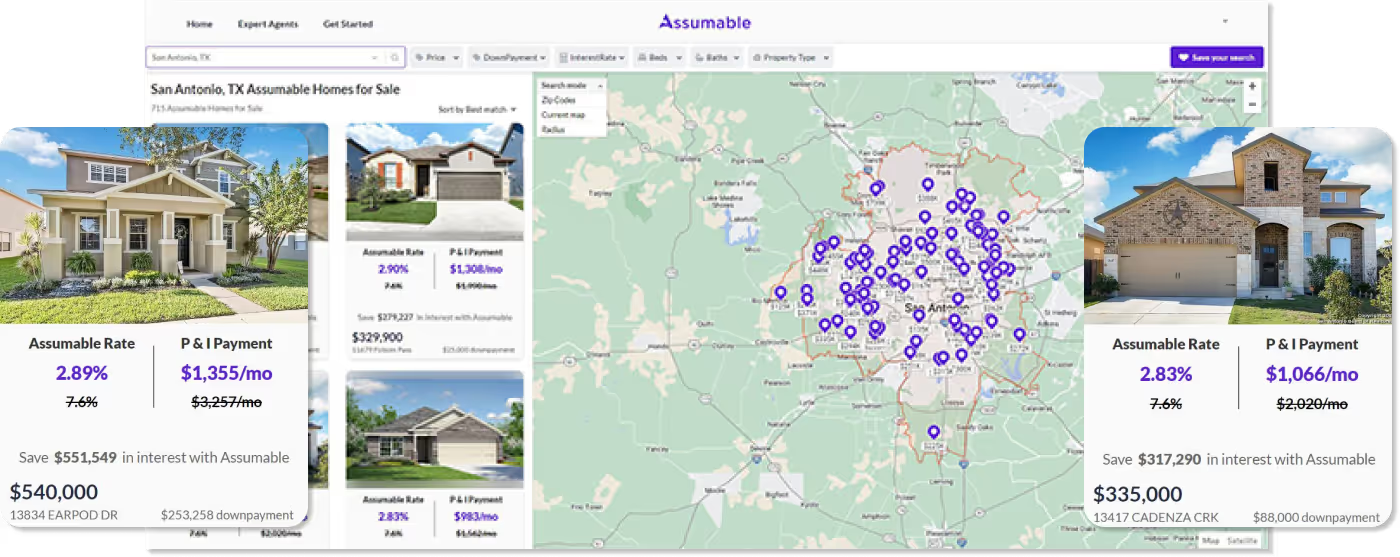

Search 42,631 assumable mortgage listings near you - save $1,187/month on average

Search Now

42,631

53%

$1,187

"Assumables are a time machine to the low-rates of the past, and we give you the keys to the DeLorean"

.png)

.png)

.png)

.png)

.png)

.png)

Our proprietary one of a kind assumable mortgage research analyzing 312,367 assumable mortgage homes from 2023-2025

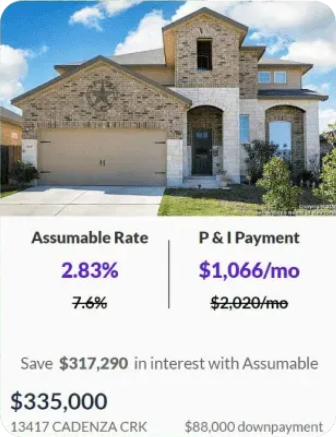

Assumable mortgages allow you to buy your home by taking over the existing low rate FHA, VA, or USDA loan on the home

Based on our analysis of 312,367 assumable mortgages, the average buyer saves $1,187/mo ($14,244/year) vs. today's rates - that's $427,305 in total interest savings over 30 years

Anyone can assume VA loan or any type of government-backed mortgage

lower monthly

payments on

average

Assumable mortgages; typically, FHA and VA assumable loans, allow you to "assume" and take over the loan at its locked in rate

Homeowners can save thousands a month - there are over 7 million assumable mortgage homes with rates below 4%

Yes - anyone can assume a VA loan. Military service is not a requirement. But the VA benefit stays with the home.

For Investors - Brokers - Agents

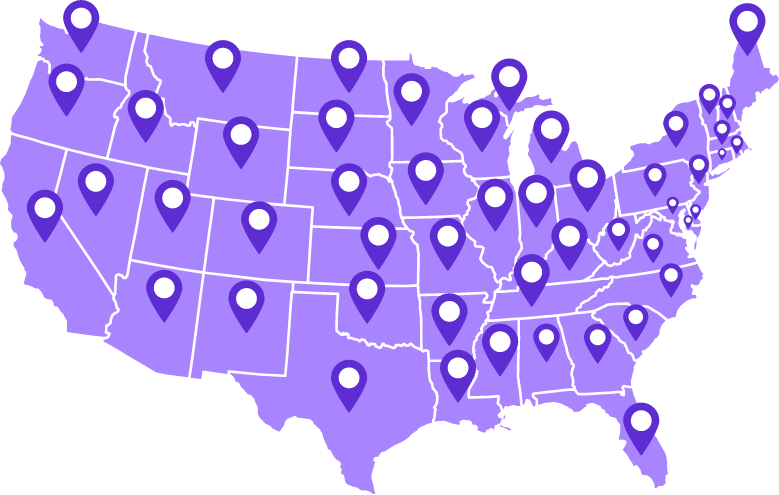

Get Off Market DataThe only assumable mortgage platform operating in all

50 states

Assumable is the only national assumable mortgage search engine and gives you all the intelligence you need to assume your dream home

Start your search

Why people love

.png)

We Don't Charge 1%

Assumable is the only platform that offers assumable mortgage homes to the entire country

Other platforms only grant access to limited markets and may charge you up to 1% of your transaction as a fee for service.

VA & FHA Assumable Homes

VA assumable loans can be assumed by anyone. Buyers can use Assumable to browse assumable VA home listings, FHA Home listings, and other assumable mortgage types.

Buyers & Sellers

Home buyers and sellers both benefit from the assumable mortgage. Buyers get a transferable, historically low rate, and sellers get to fetch a premium for their home on Assumable.io

Industry Trust

Assumable.io is trusted by realtors, brokers, and investors for its powerful platform that lets them tap into previously unavailable data streams. With the addition of Assumable Pro, industry leaders get access to off-market assumable home data no one else can offer

Get a Low Rate Home With Assumable.io

Assuming a low rate mortgage with Assumable can save you thousands a month on your payment.

Our assumable mortgage search is the only national platform available.

The #1 Resource on assumable mortgages

Assumable Mortgages

Assumable Mortgage: what it is how it works pros and cons in 2024

Learn More%20(1).png)

Assumable Mortgages

Use Assumable to find Assumable mortgage listings near you

Learn MoreAll about Assumable Mortgages and Assumable.io